Introduction

Welcome to our comprehensive guide on term insurance plans in India. In this article, we will delve into the intricacies of term insurance, shedding light on its basics, benefits, and everything you need to know to make an informed decision. As your trusted partner in personal finance, we aim to provide you with the most relevant and valuable information, ensuring that you understand the nuances of term insurance and how it can safeguard your financial future.

Term Insurance – What it is?

Term insurance is a type of life insurance that provides coverage for a specified term or period. Unlike other life insurance policies, such as whole life or endowment plans, term insurance focuses solely on providing financial protection to the policyholder’s beneficiaries in the event of their untimely demise during the policy term.

Understanding the Basics

- Coverage and Policy Term:

Term insurance offers coverage for a predetermined period, typically ranging from 5 to 40 years. The policy term is chosen at the time of purchase and should align with your specific needs and financial goals. It’s essential to evaluate factors such as your age, dependents, income, and future obligations when deciding on the appropriate policy term.

- Death Benefit:

Providing a death benefit to the designated beneficiaries is the main goal of term insurance. In the event of the policyholder’s demise during the term, the insurance company pays out a lump sum amount to the nominated beneficiaries. This payout can serve as a financial cushion, enabling your loved ones to maintain their standard of living and meet financial obligations even in your absence.

- Premiums:

Premiums for term insurance plans are generally lower compared to other types of life insurance policies. This affordability factor makes term insurance an attractive option for individuals seeking comprehensive coverage without straining their finances.

It’s important to note that the premium amount may vary based on factors such as age, health condition, lifestyle habits, and the sum assured.

Benefits of Term Insurance:

Term insurance plans offer numerous benefits that make them a popular choice among individuals looking for financial security. Let’s explore some of the advantages:

- Financial Security:

Term insurance provides a sense of financial security by ensuring that your loved ones are protected against the uncertainties of life. The death benefit received by your beneficiaries can help them pay off debts, cover living expenses, fund education for children, and maintain their lifestyle.

- Affordable Premiums:

As mentioned earlier, term insurance premiums are typically more affordable compared to other life insurance options. This affordability factor allows individuals from various income brackets to avail themselves of adequate coverage without straining their budgets.

- Flexibility:

Term insurance plans offer flexibility in terms of policy duration and coverage amount. You have the freedom to choose a policy term and sum assured that aligns with your specific requirements. This flexibility ensures that you can customize your term insurance plan to suit your changing financial needs over time.

Nowadays, return of premium plans are also available in term insurance plans, so as to remove the mental block of individuals seeking some sort of monetary benefit in case of survival of the policy duration.

Choosing the Right Term Insurance Plan in India

Now that you have a better understanding of term insurance, it’s crucial to select the right plan that caters to your unique needs. Here are some factors to consider when choosing a term insurance plan in India:

- Coverage Amount

Evaluate your financial obligations, including outstanding loans, future expenses, and dependent needs, to determine the appropriate coverage amount. Ensure that the sum assured is sufficient to provide for your loved ones in case of an unfortunate event.

- Riders and Additional Benefits

Term insurance plans often offer riders or add-ons that enhance the coverage provided. Examples include critical illness riders, accidental death benefit riders, and waiver of premium riders. Assess the riders available and choose the ones that complement your requirements.

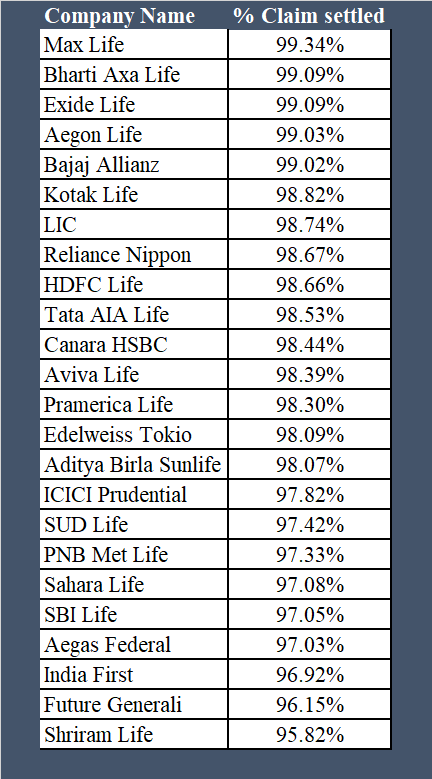

- Claim Settlement Ratio

The claim settlement ratio of an insurance company reflects its reliability in honoring policy claims. Research the claim settlement ratio of different insurers and opt for a company with a high ratio, as it indicates a greater likelihood of a smooth claim process for your beneficiaries.

The claim settlement ratio of the companies for FY-23 as per IRDA report is as given below:

Conclusion

In conclusion, term insurance is an essential financial tool that provides a safety net for your loved ones in case of your untimely demise. By understanding the basics of term insurance, the benefits it offers, and factors to consider when selecting a plan, you can make an informed decision that secures your family’s financial future.

Remember, it’s crucial to assess your individual needs, evaluate different policies, and choose a reputable insurance provider to ensure the utmost protection for your loved ones. Consult your financial advisor, who will assess your needs and requirements and accordingly suggest the best-suited term insurance plan.

#lifeinsurance #termplan #sabsepehlelifeinsurance #financialprotection #family #insurance #financialadvisor #finances #wealthcreation #