What is STP in Mutual Funds? How It Helps in Wealth Creation

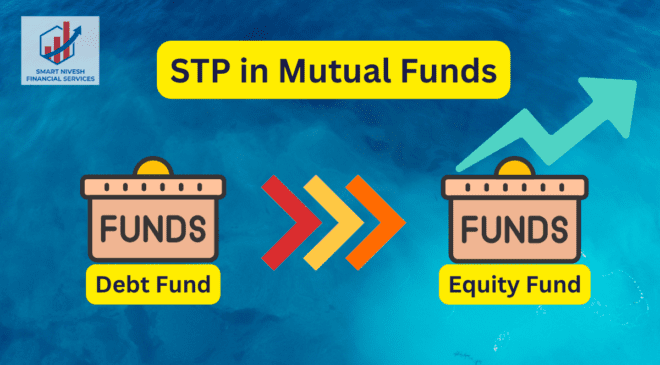

A Systematic Transfer Plan STP in mutual funds is a strategic investment approach that allows investors to transfer funds gradually from one scheme to another, typically moving from a low-risk debt fund to a higher-risk equity fund. This strategy provides a phased exposure to the equity market, helping investors reduce volatility risk and optimize returns over time. Unlike a Systematic Investment Plan (SIP), which involves new contributions, STP is ideal for those with a lump sum amount who wish to invest systematically, balancing risk and growth potential.

Through STP, investors can leverage market fluctuations to average out costs and enhance wealth creation potential. With options like fixed, flexi, and capital appreciation STP, investors can tailor their transfer strategy to align with specific financial goals. Despite its advantages, it’s essential to understand tax implications and evaluate market conditions before opting for STP.