Investing in a safe and secure manner is always a priority, especially for senior citizens who have retired and are looking for a reliable source of income. The Senior Citizen Savings Scheme (SCSS) is a government-backed savings scheme designed specifically for individuals aged 60 years and above.

Introduction:

SCSS is a government-backed savings scheme offered to senior citizens above the age of 60 years offered through various public sector banks and post offices. It was launched in 2004 to provide senior citizens with a secure investment option that generates regular income.

It is a low-risk investment option that yields a fixed rate of interest, making it an attractive investment option for senior citizens.

- Eligibility Criteria for SCSS: To be eligible for SCSS, the investor must be an Indian citizen above the age of 60 years. Additionally, retired defense personnel can invest in SCSS after attaining the age of 50 years. The scheme also allows for opening joint accounts with one’s spouse.

- Investment Limit: As per recent amendments of Budget 2023-24, an investor can invest a maximum amount of Rs. 30 lakhs in SCSS, and the investment must be made within one month of receiving the retirement benefits.

- Interest Rates and Calculation: The current interest rate for SCSS is 8.20% per year, payable quarterly. Interest is calculated from the date of deposit and paid quarterly.

- Investment Tenure and Extension Options: The tenure for SCSS is five years, which can be extended for another three years upon maturity. After extending the scheme, the investor cannot make any fresh deposits, and all payouts are made in the extended tenure.

- Payout Options: SCSS offers regular payouts in the form of interest payments, which are made quarterly. After maturity, the entire principal amount is returned to the investor.

- Taxation Benefits: Investments made in SCSS are eligible for tax deductions under section 80C of the Income Tax Act. However, interest earned on the investment is taxable.

- Safe and Secure Investment Option: SCSS is a government-backed scheme, making it a safe and secure investment option for senior citizens.

- High-Interest Rates Compared to Other Options: SCSS offers higher interest rates compared to other fixed-income investment options like fixed deposits.

- Regular, Reliable Payouts: Investing in SCSS ensures the investor receives regular, reliable payouts in the form of interest payments. Since it is backed by government of India, the chances of default are low.

- Flexibility in Investment Amount: Investors can invest up to a maximum of Rs. 30 lakhs in SCSS, offering them flexibility in their investment amount.

- Lack of Liquidity: SCSS lacks liquidity, which means the investor cannot withdraw their money before the end of the investment tenure. Partial withdrawals are not allowed, and the investment can only be terminated in case of the investor’s demise.

- Penalty for Premature Withdrawal: While SCSS is designed as a long-term investment option, premature withdrawals are permitted under certain circumstances. However, a penalty is imposed based on the duration of the investment.

Here’s an overview of the premature withdrawal penalties:

– Withdrawal within a year: Entire interest component will be recovered

– Withdrawal after 1 year but before the completion of 2 years: 1.5% of the deposit

– Withdrawal on or after the completion of 2 years: 1% of the deposit amount.

- Changes in Interest Rates: Interest rates on SCSS are subject to change, which can impact the investor’s returns.

For Example:

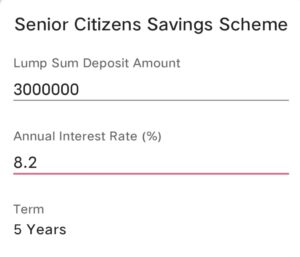

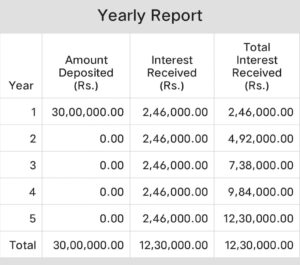

Lets assume Mr. Lalit has retired and invests a part of his retirement corpus i.e. Rs. 30 Lacs in SCSS.

Thus, the summary at end of 5 years would be as below:

Conclusion:

In conclusion, SCSS is a safe and secure investment option for senior citizens looking for a reliable source of passive income. With attractive interest rates, guaranteed returns, and tax benefits, SCSS provides retirees with financial stability and a regular income stream. However, it’s advisable to carefully consider the terms and conditions, including the penalty for premature withdrawals, before making investment decisions.

Consult with a financial advisor to assess whether SCSS aligns with your long-term financial goals and risk tolerance.

#retirement #regularincome #finance #guaranteedreturns #SCSS #retired #seniorcitizen #investments