Edelweiss Technology fund is a new fund offering (NFO) from Edelweiss Mutual Fund.

Fund Type

- Edelweiss Technology Fund is an Open-ended equity scheme.

- This fund will invest in technology and technology-related companies.

- This fund is a sectoral fund.

Launch Date

The NFO will be open for subscription on February 18, 2024. The last date for applying for the NFO is February 28, 2024.

The minimum investment amount is Rs. 100 for lumpsum and SIP.

Objective

To achieve long-term capital appreciation by investing in a diversified portfolio of technology and technology-related companies across various sectors and market capitalizations.

Why Edelweiss Technology Fund?

-

Digital technologies have ignited a revolution across industries, reshaping everything from manufacturing to healthcare.

-

From communication to commerce, AI and automation are weaving a new landscape across diverse sectors.

-

The relentless march of technology has left no sector untouched, driving profound transformations in business models, workforces, and consumer experiences.

-

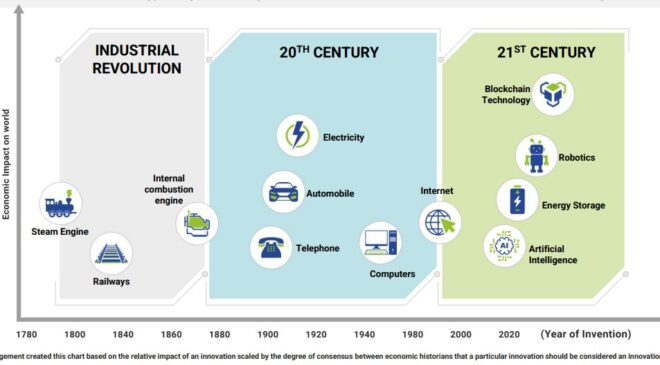

From steam engines to smartphones, technology has been an economic game-changer. But buckle up, the next wave of innovation is about to rewrite the rules.

-

Do you think the printing press was revolutionary? The coming tech tsunami could reshape entire industries and redefine prosperity itself.

Investment Strategy

-

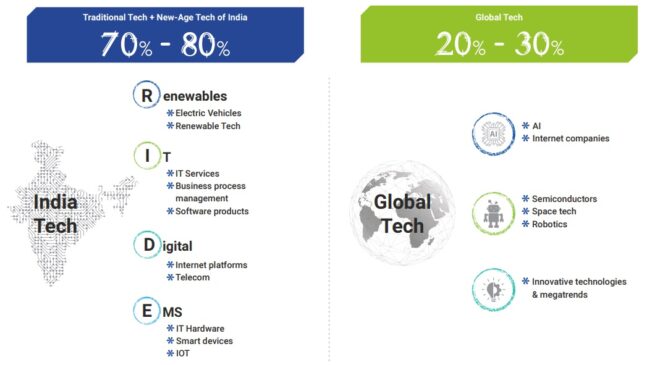

The global wave of technological disruption is reshaping every industry. The fund will try to capture these opportunities across sectors, both in India and on the world stage.

-

From AI to bioengineering, a tech revolution is unfolding sector by sector. The fund is positioned to identify and capitalize on these advancements, driving innovation in India and beyond.

-

No industry is immune to the tech revolution. The fund lays thurst on the hunt for game-changing opportunities across the spectrum, empowering growth in India and globally.

- The fund manager will actively select stocks based on their fundamental analysis, focusing on companies with strong growth potential, competitive advantages, and sustainable business models.

Why invest in Technology Fund ?

Risks associated with the fund

- This fund is suitable for investors with a very high-risk profile, as this is a sectoral fund that will have exposure to the technology sector and international equities.

- Let us understand the key risks associated with the fund:

Time Horizon

- Edelweiss Technology fund is suitable for investor with minimum time horizon of 5 years.

Suitability

This fund is suitable for –

- Investors seeking long-term capital appreciation (minimum 5 years)

- Investors with a high-risk tolerance (the technology sector can be volatile)

- Investors who understand the risks associated with investing in international equities

Our View:

Edelweiss Technology Fund: Riding the Tech Wave?

The year is 2024, and technology continues to be a driving force of change. With this backdrop, Edelweiss Mutual Fund launches the Edelweiss Technology Fund, an NFO targeting tech and tech-related companies across India and globally. But the question remains: should you invest?

This new fund aims to capture long-term capital appreciation. While the specific investment strategy is yet to be revealed, it promises a focus on growth potential, competitive advantages, and sustainable business models. Sounds promising, but remember, the tech sector is inherently volatile. So, understanding your risk tolerance is crucial.

The fund boasts certain advantages:

- Global exposure: Invests in both Indian and international tech, potentially diversifying risk.

- Active management: A fund manager actively selects stocks, aiming to outperform the benchmark.

- Long-term focus: Encourages patient investing, aligning with the tech sector’s potential.

However, remember the caveats:

- New fund, no track record: Past performance is unavailable, making assessment harder.

- High risk: The tech sector faces constant change, meaning potential for significant losses.

- Limited information: Until the official launch and prospectus, details like expense ratio and minimum investment remain unknown.

Disclaimer:

This information is for informational purposes only and should not be considered financial advice. Please consult with a qualified financial advisor before making any investment decisions.