Edelweiss Business Cycle Fund: Navigating Investment Opportunities with Precision

Investing in mutual funds can often feel like navigating through a maze of endless options, each promising lucrative returns. However, discerning investors know that the key to successful investing lies in understanding market cycles and making informed decisions. The Edelweiss Business Cycle Fund, a new entrant in the mutual fund space, offers a unique approach to capturing market trends through its innovative factor-based investment strategy.

Understanding the Edelweiss Business Cycle Fund

Investment Philosophy: The Edelweiss Business Cycle Fund employs a proprietary factor-based approach to identify and capitalize on prevailing business cycle trends. This methodology involves analyzing multiple factors—Growth, Quality, Value, and Momentum—to construct a diversified portfolio of stocks poised to perform well during different phases of the business cycle.

Key Features:

- Factor-Based Strategy: The fund’s proprietary model analyzes current data to spot business cycle trends, ensuring a data-driven and evidence-backed approach.

- Diversified Portfolio: The fund aims to maintain an equal allocation between large-cap and mid/small-cap stocks, ensuring a balanced exposure across market segments.

- Sector and Stock Exposure Limits: The fund caps sector exposure at 40% and single stock exposure at 10%, mitigating risks associated with over-concentration.

Investment Style and Process

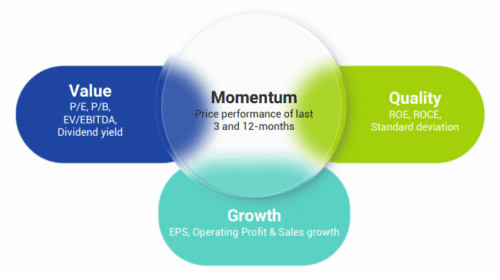

Factor Investing: The fund’s investment process hinges on factor investing, which involves selecting stocks based on specific characteristics that drive performance. The key factors considered are:

- Growth: Metrics like EPS, operating profit, and sales growth.

- Quality: Indicators such as ROE, ROCE, and standard deviation.

- Value: Valuation ratios including P/E, P/B, and EV/EBITDA.

- Momentum: Price performance over the last 3 and 12 months.

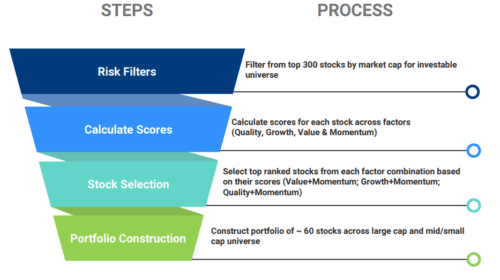

Stock Selection Process:

- Risk Filters: Filtering from the top 300 stocks by market capitalization to create an investable universe.

- Scoring: Calculating scores for each stock across the identified factors.

- Selection: Choosing top-ranked stocks from each factor combination.

- Portfolio Construction: Building a portfolio of approximately 60 stocks, balancing large-cap and mid/small-cap exposure.

Sector Focus and Market Trends

Sector Allocation: The Edelweiss Business Cycle Fund does not adhere strictly to traditional sector allocation. Instead, it dynamically adjusts its focus based on which sectors are performing well in the current business cycle. Historically, sectors like Financial Services, Information Technology, Consumer Discretionary, and Healthcare have been significant contributors to the fund’s returns.

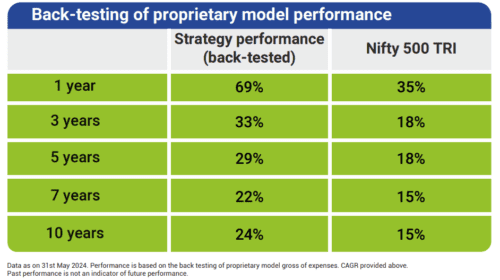

Performance Insights: Back-testing of the fund’s proprietary model has demonstrated consistent outperformance compared to the Nifty 500 TRI across various time frames, reinforcing the effectiveness of its factor-based strategy. For instance, over a 10-year period, the fund’s strategy delivered a CAGR of 24% compared to 15% for the Nifty 500 TRI.

Suitability for Investors

Ideal for Informed Investors: The Edelweiss Business Cycle Fund is well-suited for investors who seek:

- Active Management: A fund that dynamically adjusts its portfolio based on market trends.

- Diversification: Exposure to a balanced mix of large-cap and mid/small-cap stocks.

- Long-Term Growth: Potential for higher returns through a data-driven, factor-based investment approach.

Risk Considerations: As with any investment, there are risks involved. The fund’s reliance on macroeconomic indicators and business cycle trends means it may face challenges during periods of rapid economic shifts or unforeseen market disruptions. However, its diversified and evidence-backed strategy aims to mitigate such risks effectively.

Conclusion

The Edelweiss Business Cycle Fund stands out as an innovative option for discerning investors seeking to leverage business cycle trends for enhanced returns. Its factor-based approach, diversified portfolio, and dynamic sector allocation make it a compelling choice for those looking to navigate the complexities of market cycles with precision.

Investors interested in this fund should consider their own financial goals, risk tolerance, and investment horizon of a minimum 5 years, and consult with a financial advisor to determine its suitability for their portfolio. As always, a well-informed decision is the cornerstone of successful investing.

#MutualFunds #EdelweissBusinessCycleFund #Investing #FactorInvesting #MarketTrends #InvestmentStrategy #FinancialPlanning #BusinessCycles #DiversifiedPortfolio #LongTermGrowth #ActiveManagement #FinancialAdvisor #InvestmentBlog #StockMarket #InvestmentOpportunities