Investing successfully in today’s fast-paced and ever-changing financial markets requires more than just a long-term perspective. Economic conditions are not static; they evolve through cycles, influencing sectors, industries, and individual companies in unique ways. Recognizing this dynamic, Bandhan Mutual Fund has introduced a new offering to help investors navigate these changes—the Bandhan Business Cycle Fund. This New Fund Offer (NFO) is designed to leverage the natural ups and downs of the economy by strategically allocating investments across sectors based on where we are in the business cycle.

In this article, we will take an in-depth look at the Bandhan Business Cycle Fund, its objectives, key features, and why it could be a compelling choice for investors seeking growth across market cycles.

Understanding the Business Cycle

Before delving into the specifics of the Bandhan Business Cycle Fund, it’s important to grasp the fundamentals of the business cycle itself. A business cycle refers to the fluctuating levels of economic activity that an economy goes through over time. These cycles are generally divided into four distinct phases:

- Expansion: A period of robust economic growth, increased production, and rising employment.

- Peak: The highest point of economic activity before growth slows down.

- Contraction: Economic activity starts to decline, marked by lower production, reduced demand, and rising unemployment.

- Trough: The lowest point, representing a recession or significant slowdown before the next phase of recovery begins.

These cycles influence all sectors differently. For example, consumer discretionary and industrial sectors often perform well during periods of expansion, while defensive sectors such as utilities and healthcare tend to hold up better during contractions. Successful investing requires being in the right sectors at the right time, something Bandhan’s new fund is designed to address.

Bandhan Business Cycle Fund: Objective and Strategy

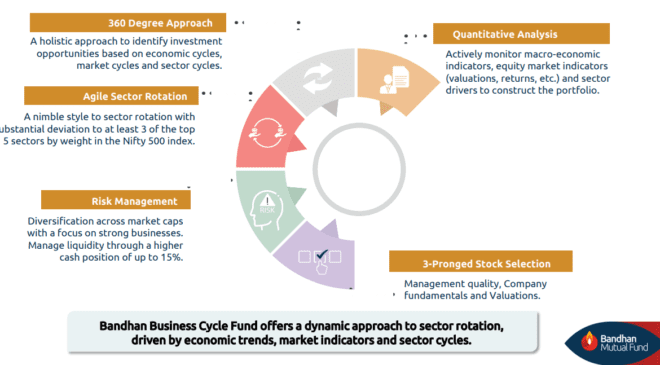

The Bandhan Business Cycle Fund is an open-ended equity scheme, meaning it will invest primarily in equities and equity-related securities. Its core objective is to generate long-term capital appreciation by tactically investing across different sectors, depending on the prevailing phase of the business cycle.

Unlike traditional mutual funds that may have a static sector allocation, the Bandhan Business Cycle Fund is dynamic, adjusting its sectoral exposures based on where the economy is in the business cycle. The idea is simple—identify sectors and businesses that are likely to benefit the most during each phase and reduce exposure to those that may be adversely impacted.

For example:

- During expansion, the fund might increase its allocation to cyclical sectors like consumer discretionary, industrials, and financials.

- In periods of contraction or slowdown, it could shift towards defensive sectors like utilities and healthcare, which are less sensitive to economic downturns.

The fund seeks to offer investors a smooth ride through market fluctuations by actively managing these shifts.

Key Features of the Bandhan Business Cycle Fund

1. Dynamic Sectoral Allocation

The Bandhan Business Cycle Fund employs a dynamic sector rotation strategy. Unlike funds that adhere to a specific theme or market segment, this fund allows the fund managers to rotate between sectors and industries, capitalizing on growth in sectors best positioned for the current economic environment.

By investing in companies that stand to gain during different phases of the business cycle, the fund is designed to optimize returns while mitigating risk. This dynamic approach is well-suited for investors looking to balance between growth opportunities and stability in their portfolios.

2. Flexibility Across Market Capitalizations

The Bandhan Business Cycle Fund is not limited to any particular market capitalization. Whether it’s large-cap, mid-cap, or small-cap stocks, the fund can allocate its resources wherever the fund managers see potential. This flexibility allows the fund to seek growth across the entire market spectrum.

Historically, different market caps perform better during different business cycle phases. Large-cap stocks might provide stability during economic downturns, while small and mid-caps could offer higher growth potential during periods of expansion.

3. Actively Managed Fund

The fund is actively managed, meaning the investment team constantly evaluates market conditions and adjusts the portfolio to align with current economic indicators. Active management is particularly beneficial in a fund like this, as timing sectoral shifts and company selection is critical to maximizing returns across business cycles.

4. Open-ended Structure

The Bandhan Business Cycle Fund is an open-ended equity scheme, allowing investors to enter and exit the fund anytime. The New Fund Offer (NFO) opens on September 10, 2024, and closes on September 24, 2024. After the NFO period, investors can invest in the fund on an ongoing basis.

5. Minimum Investment

For those interested in participating in the NFO, the minimum initial investment is ₹1,000. This relatively low entry point makes the fund accessible to a wide range of investors, from beginners to seasoned professionals looking to diversify their portfolios.

6. Tax Efficiency

As with any equity mutual fund, investors in the Bandhan Business Cycle Fund can benefit from tax efficiency. Investments held for more than a year are subject to long-term capital gains tax, which is generally lower than short-term rates.

Why Consider the Bandhan Business Cycle Fund?

1. Adaptability to Economic Changes

One of the fund’s most compelling features is its ability to adapt to changing economic conditions. Economic cycles can shift unexpectedly, and having a fund that proactively adjusts its sectoral allocations can potentially help investors avoid significant losses during downturns while capturing upside during expansions.

2. Diversified Exposure

Because the fund invests across various sectors and market capitalizations, it provides investors with diversified exposure to the equity markets. This can help reduce the overall risk in a portfolio by not being overly concentrated in one particular area of the market.

3. Opportunity for Growth

By focusing on sectors poised to benefit from each phase of the business cycle, the Bandhan Business Cycle Fund offers investors an opportunity to capture growth in companies that are well-positioned for the current economic environment.

4. Professional Management

The fund is managed by a team of professionals with experience in navigating the complexities of economic cycles. This active management can add significant value to investors who may not have the time or expertise to make sectoral and stock selection decisions on their own.

Who Should Invest?

The Bandhan Business Cycle Fund is ideal for investors with a long-term horizon who are looking to grow their wealth by investing in equities. It is suitable for those who want:

- Exposure to a dynamic actively managed equity fund.

- Diversification across sectors and market caps.

- An investment that can adapt to changing economic conditions.

- Investors with a time horizon of 5 years+

However, like all equity investments, this fund carries a certain level of risk. Market conditions, interest rates, and global events can all impact the performance of the fund. Therefore, investors need to assess their risk tolerance and financial goals before investing.

Conclusion

The Bandhan Business Cycle Fund offers a unique investment approach by aligning its strategy with the natural ebb and flow of the business cycle. Its dynamic sectoral allocation, flexibility across market caps, and active management make it a compelling option for investors looking to capitalize on economic shifts while maintaining a diversified equity portfolio.

With the NFO open until September 24, 2024, now may be a good time for investors to consider how this fund could fit into their long-term financial plans. For those looking to stay ahead of the curve and benefit from economic trends, the Bandhan Business Cycle Fund provides a strategic and adaptable investment solution.

For more details, you can click on the link –> https://wa.me/919930682451

- #BandhanMutualFund

- #BusinessCycleFund

- #MutualFunds

- #InvestmentStrategy

- #EquityInvesting

- #NFO

- #IndianStockMarket

- #FinancialPlanning

- #ActiveInvesting

- #WealthBuilding