Introduction

A Systematic Withdrawal Plan (SWP) is a financial instrument that allows investors to withdraw a fixed amount of money from their mutual fund investment at regular intervals. This can be a great way to generate a steady income stream, especially for retirees or people who need supplemental income.

Benefits of SWP:

There are several benefits to using SWP:

- First, they provide a predictable income stream. This can be helpful for people who need to budget their expenses or who want to ensure that they have a steady source of income in retirement.

- Second, SWPs can help to preserve the value of your investment. When you withdraw money from a mutual fund, you are selling some of your units. If the market is down, you may sell your units at a loss. However, if you use an SWP, you will only sell a fixed amount of money each month, regardless of the market conditions. This can help to protect your investment from market volatility.

- Thirdly, SWPs are tax efficient. It helps to save taxes which otherwise would be quite high considering other available investment avenues.

Considerations for SWP:

Of course, there are also some considerations to keep in mind when using SWPs.

- First, you need to make sure that you choose the right mutual fund for your needs. Some mutual funds are more suitable for SWPs than others. For example, equity-oriented mutual funds can be more volatile than debt-oriented mutual funds. This means that you may be more likely to experience losses if you use an equity-oriented mutual fund for an SWP.

- Another consideration is the frequency of your withdrawals. If you withdraw money too often, you may not give your investment enough time to grow. However, if you withdraw money too infrequently, you may not have enough income to meet your needs.

How to Se Up an SWP

To set up an SWP, you will need to contact your mutual fund distributor/financial advisor/mutual fund company. They will ask you for some information, such as the amount you want to withdraw each month and the frequency of your withdrawals. They will also ask you to choose a mutual fund that is suitable for SWPs.

Once you have set up your SWP, the mutual fund company will automatically withdraw the money from your account and deposit it into your bank account. You can then use the money as you need it.

Additional Information:

Here are some of the factors to consider when choosing a mutual fund for a SWP:

-

- The fund’s investment objective

- The fund’s risk profile

- The fund’s historical performance

- The fund’s fees

- Here are some of the factors to consider when determining the frequency of your withdrawals:

-

- Your income needs

- Your risk tolerance

- The volatility of the market

Example of SWP:

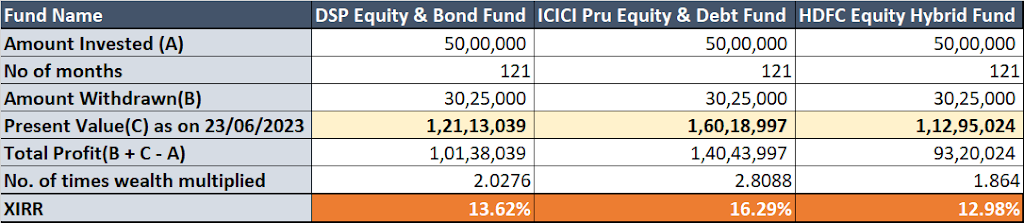

We have considered 3 funds – DSP Equity & Debt Fund, ICICI Prudential Equity & Debt Fund and HDFC Equity Hybrid Fund.

We have assumed to have invested an amount of Rs. 50 Lacs in May 2013 i.e. 10 years back. Also, the monthly withdrawal considered is Rs. 25,000 i.e. 6% of invested amount.

The current valuation as on 23.06.2023 are as below:

As can be seen, a regular income stream of Rs. 25,000 per month was withdrawn by the investor. In 10 years, the total withdrawal was Rs. 30 Lacs. Apart from this, there is substantial wealth creation also which would have easily beaten inflation and also would help leave behind a legacy.

Conclusion:

SWPs can be a great way to generate a steady income stream and preserve the value of your investment. However, it is important to choose the right mutual fund and to withdraw money at the right frequency. If you are considering using an SWP, it is a good idea to speak with a financial advisor to get personalized advice.